Tuesday, December 1, 2009

Golden Capital Network is thankful for the support during the past 10 years from the early stage angel and venture capital investment communities, and from the startup entrepreneurs we have had the pleasure to serve. As we enter 2010, we are pleased to present a new initiative that will elevate our ability to provide value and track metrics from innovation companies well beyond the startup phase.

GROWCalifornia is a project by Golden Capital Network to provide solutions for innovative growth businesses that drive the economy, service providers that serve them, and the public sector that supports them.

The purpose of GROWCalifornia is to identify, survey, report and make service referrals to 1000 high-performing, locally-based innovation companies in the state.

GROWCalifornia provides a unique value proposition by reaching out to locally-based high-growth companies and collecting primary data about their performance, their innovations, their job creation, their business needs, and their opinions on matters of business climate, talent and capital.

GROWCalifornia surveys and reports on businesses from various industry sectors and growth stages that meet unique criteria for potential expansion and positive economic impact. These data reports are valuable economic planning and rapid response tools for economic development, workforce training, elected officials and the business community at large.

The results of the reports are released at networking and press conference events to discuss the findings, offer innovation-focused business content, and to benefit companies, service providers and officials through visibility and networking.

Individual growth company referrals identified through the survey process go directly to the GROWCalifornia partner network, whose members pay an annual membership fee for the opportunity to offer operational value to the growth companies.

The GROWCalifornia partner network delivers critical support to growth companies. Members of the network represent multiple disciplines and are screened for quality and integrity. Direct referrals are made via email with links to online profiles of the companies and the providers.

The GROWCalifornia index divides the state into 20 different regions and tracks 1000 companies that represent high likelihood to generate new products, new revenue and new high wage job opportunities. Growth business criteria include:

• Growth focused management

• Locally owned or operated headquarters or base of operations

• Current or potential national and global markets

• Scaleable products or services

• Significant process or product innovations

GROWCalifornia is the first project of its kind to recognize, quantify, report and support innovation, entrepreneurship, risk capital and regional affinity as key drivers for jobs and regional economic growth.

If you are a growth company, a service provider or a workforce/economic development official interested in joining GROWCalifornia, find out more by calling 530-893-8828.

Monday, August 3, 2009

Venture Island - North State: The Trading Post

Tuesday, July 7, 2009

Pandora Won

Looks like there's finally an agreement in place to permit internet radio stations to operate profitably. The New York Times reported this morning that SoundExchange has agreed to a royalty plan. Under the new arrangement, webcasters with revenues in excess of $1.25 million will pay a per-song fee ranging over time from .08 to .14, or 25% of revenue, whichever is greater.

Looks like there's finally an agreement in place to permit internet radio stations to operate profitably. The New York Times reported this morning that SoundExchange has agreed to a royalty plan. Under the new arrangement, webcasters with revenues in excess of $1.25 million will pay a per-song fee ranging over time from .08 to .14, or 25% of revenue, whichever is greater.Thursday, July 2, 2009

Venture Island Starts With A Splash At the Whole Pina Colada

To kick off the Venture Island Northstate competition series this year, we hosted the Whole Pina Colada June 23 at Canyon Oaks Country Club in Chico, the home of many classic Golden Capital Network events over the years, (and also the site of a great many hacks on the golf course by GCN staffers).

It’s a pastoral canyon setting and perfect for this type of loose business networking affair. Unfortunately, the Canyon Oaks bar was out of Pina Colada mix, so Sierra Nevada Pale Ale was the able fallback for those wishing to imbibe. (In truth, Mai Tais are really a better rum drink anyway -- 2 parts light Bacardi, 1 part pineapple juice, 1 part orange juice, a dose of Cointreau, and a dark Myers floater on top…mmmm).

The evening began with intros from Stewart Knox, a great resource and advocate for Northstate business through his work with the esteemed Charlie Brown at NorTEC, our regional workforce investment board. Stewart and Charlie are two of the most innovative workforce guys in the business, which is interesting since they represent the most rural, underpopulated regions in the state. They are the local overseers of the Northstate WIRED program, an innovation catalyst initiative brainstormed by former U.S. Dept. of Labor assistant secretary Emily DeRocco, and apparently gaining some traction in the Obama administration.

Our own President and CEO Jon Gregory was next up with the outline of how the Venture Island competition series will work this year: Three events with business challenges and eliminations each time until we get the final three showdown.

- July 23, Trading Post

All the companies from the last event, plus any others that make the cut before then, engage in a 2-minute pitch off. Top contenders move on. - Sept. 10, Snake Pit

Role-play event to really get into the heads and hearts of the entrepreneurs and test not only their business savvy, but also their leadership, communication and decision-making skills - Oct. 29, Make or Break Beach

Five minute business presentation with q&a - Oct. 29, Climbing Kahuna Mountain

Secret challenge for the final three. This is the final showdown, and will take place at the Chico Economic Planning Corp. business awards dinner. We'll crown 1st, 2nd and 3rd, and all three will ascend to the California Business Ascent State Championships Nov. 17-18 in San Diego.

In this vein, Sandy indicated that during a conversation with high-level officials in the Obama White House there was continued support by the new administration for the WIRED innovation initiative started by Dept. of Labor about four years ago. The WIRED initiative funds Venture Island and other GCN business catalyst activities, along with many other important innovation efforts across the country, so this was good news for us, as our current grant expires the end of this year.

The first panel of the night was the one I was most looking forward to, and I wasn’t disappointed. Titled simply, “Business Success,” this panel featured five successful North State entrepreneurs telling their stories and imparting some gems of wisdom they’ve picked up along the way. The panelists included Rob Innes, from Innespace Productions, Matthew de Bord from Origami Foods, Kendall Bennett from A Main Hobbies, Todd Radke from ATC Hardware Systems and Andy Keller from Chico Bag.

Perseverance and passion are the words that come to mind when I try to generalize the session. Specific advice I recall included:

- Protect your intellectual property (get the international patents, too)

- Maintain customer satisfaction (you'll have a problem someday. You'll be judged by how you handle it)

- Be ready for challenges with manufacturing quality control (in China, esp. You'll have to take many trips to stay on top of it)

- Focus on the right market (identify what you really do best and avoid the temptation of the latest bright, shiny object)

- Find the right talent (there's a lot available cheap right now. Be cautious with stock incentives)

The final session of the night had by far the most energy, and rightly so. Thirteen early stage entrepreneurs standing before the world (or at least the 200 people or so in attendance) making their two minute pitches for capital, talent, advisors or whatever it is they think they need to get to the next level. The top five are granted automatic pass through the first elimination round of Venture Island: The Trading Post.

The five winners were:

- Jim Philips, Inovius Software, Redding

- Jim Crummett, Telecom Lifters, Browns Valley

- Joe Andrew, Novasyte, Chico

- Julie Atlas, Bumblebee Transport, Paradise

- Steve Heumann, Cable Master, Paradise

My two favorite picks from the also-rans were CleanTraks and the grill lid lifter – probably because I could use both of them yesterday.

CleanTraks has a product that incorporates a doggie bag holder into a retractable leash. It includes waterless hand soap, and no, this is not for leftovers from the restaurant, but for what the dogs themselves leave behind. The company is pretty much pre-product and pre-revenue, so they’ve got a long road to travel, but CleanTraks was a neat, innovative, well presented concept, and with something like 75 million dogs in the U.S. and a corresponding $500 million annual addressable market in dog accessories, they could have something big on their hands with the right marketing.

Grill lid lifter was yet another case of an intrepid inventor solving one of American’s most vexing problems: how do you keep a beverage in one hand, a basting brush in another, and get the grill open when you need to sauce the ribs? The answer, of course, is the grill lid lifter: Step on a button with your foot and the grill lid lifts. This one’s just on paper, but Jason Darrow from Yreka has some nice business chops and I wouldn’t bet against him to make a compelling case for this baby as the competition unfolds.

Our next Venture Island event is July 23 at the Enloe Conference Center, when all the companies from the Pina Colada, plus whoever else comes on board between now and then, face-off in the Trading Post.

As always, more information about our Business Ascent challenge events, our investor judges and panelists, and the company profiles and video of the elevator pitches are available for viewing on our web portal, in this case at VentureIsland-Northstate.Com

Monday, June 22, 2009

Liquidity Launches

June has seen the start of three new liquidity markets for private equity assets. The IPO market dried up very quickly after the turn-of-the-century dotcom market bust, and most exits since then have been in the form of mergers and acquisitions.

June has seen the start of three new liquidity markets for private equity assets. The IPO market dried up very quickly after the turn-of-the-century dotcom market bust, and most exits since then have been in the form of mergers and acquisitions.Saturday, May 23, 2009

The Sound of Web 3.0

We've long been fans of Tim Westergren and the Music Genome Project. In 2003, at our East Bay Venture Capital Conference, Savage Beast Technologies (as his company was called then) was honored as the best presenting company at the event.

We've long been fans of Tim Westergren and the Music Genome Project. In 2003, at our East Bay Venture Capital Conference, Savage Beast Technologies (as his company was called then) was honored as the best presenting company at the event. Well, earlier this week, Pandora took it up a notch. The premium subscription is now branded Pandora|One, and offers several improvements, the most immediately noticeable being a higher bitrate, up to 192Kbps, which is audibly superior if you have the broadband to support it. But the coolest thing is the new desktop client, that runs on the Adobe AIR stack, a development platform that boasts that it is also "beyond the browser".

Well, earlier this week, Pandora took it up a notch. The premium subscription is now branded Pandora|One, and offers several improvements, the most immediately noticeable being a higher bitrate, up to 192Kbps, which is audibly superior if you have the broadband to support it. But the coolest thing is the new desktop client, that runs on the Adobe AIR stack, a development platform that boasts that it is also "beyond the browser". Tuesday, April 21, 2009

Cliffhanger

“Recessions are the best times to start companies! We always invest in downturns! There are fewer competitors, and you get a better caliber of entrepreneur! Dollars can stretch further because salaries and rents are lower! We’re not looking to take a company public for years, so why would we run our companies based on the public markets and macro economy?”Her thesis is that because VC performance is evaluated on ten-year cycles, they never really corrected after the public market bust in 2001-2002. With declining returns, VCs are reluctant to write checks without a resilient growth category defying the current conditions. Certainly she is not alone in this opinion.

What interests us at ReadWriteWeb is the small subset that is (a) seed- and early-stage, and (b) Internet-specific. So we drilled into those numbers. Q1 2009 saw 34 deals, with a total of $138 million invested. Is that good or bad? Well, 34 companies getting their first investment round is one helluva celebration for 34 entrepreneurs, their teams, and their investors.So this is sophistry, but there is a point to it. This most recent boom cycle, at its peak in 4Q07, recorded $454 million investment in early-stage internet deals, as contrast to $4.5 Billion in 1Q00. Less than 10% is in play this time around, so, as Lunn puts it, "we don't have as far to fall".

How about 15 deals worth $76 million in Q2 2003? That was actually the lowest in the 53 quarters tracked by MoneyTree.

If you want to be positive, then, our position now is twice as good as it was in Q2 2003. So here is an alternative headline:

"VC investment in Internet startups is up 100% from last downturn".

No one is denying that the trend is down, but we're inclined to the RWW view that while total number of deals and amount invested have both declined from the peak, there's far more reason to be optimistic than otherwise.

Friday, April 10, 2009

Monterey Bay Innovation Showcase Webcast

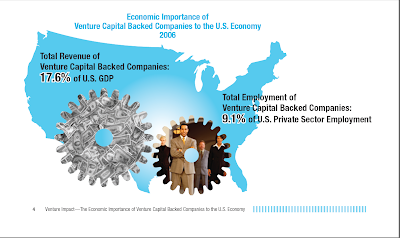

California Business Ascent: The Solution to Create Sustainable Jobs

It is important to point out that an economic recovery solution exists. The solution, as it always has been in this country, rests on the shoulders of innovative, locally owned businesses run by visionary entrepreneurs. They exist in every region and community in the United States, rural or urban, inland or coastal, northern or southern. Golden Capital Network has coined a term to describe these companies: GLOBIEs. GLOBIEs are businesses that provide products and services that create new industry categories, grow existing ones, or capture more of an industry’s market share, thereby growing their businesses, generating revenue, creating jobs and stimulating new tax revenue. GLOBIEs can be startup companies, emerging growth companies, or mature enterprises with existing international or global market presence. They all start small, but many of them grow big and become market leading companies in their industries.

- Tapping into a geography that has a growing need for a GLOBIEs product or service

- Creating a new industry category, or capturing a larger share of an existing industry sector

- Providing a compelling solution for governments, businesses or consumers that either saves money, increases value, or makes things more efficient

- Creating a diversion from the day-to-day grind of life

- access to all forms of risk capital

- access to talent, from skilled technicians and labor workers, to executive management, to boards of directors and informal advisors with specialized industry or functional expertise

- access to professional services such as those associated with intellectual property, finance and accounting, risk management, marketing and sales, executive search, web development, and many others

- access to business development whether it be through channel partners, VARs and other strategic partners all the way up to customers themselves

- access to peers to share war stories, offer strategic advice, and form new alliances.

The challenge for GLOBIEs is four-fold. This is where economic development efforts can step in and add value. First, the GLOBIE “ecosystem” does not naturally self-align in a community or region. GLOBIEs frequently operate in isolation without access to the critical resources they need.

Tuesday, March 31, 2009

Lights, Camera, Action!

We’re very happy to announce the public launch of the California Business Ascent video webcast series, showcasing the most exciting startups you’ve never heard of. For ten years we’ve introduced more than a thousand early stage ventures to our network of active investors at dozens of Golden Capital Venture Capital conferences throughout California and Nevada, and more than $1.6 Billion has been invested in our alumni.

We’re very happy to announce the public launch of the California Business Ascent video webcast series, showcasing the most exciting startups you’ve never heard of. For ten years we’ve introduced more than a thousand early stage ventures to our network of active investors at dozens of Golden Capital Venture Capital conferences throughout California and Nevada, and more than $1.6 Billion has been invested in our alumni.Now we're taking it to the web, live and direct. We are planning an ambitious program of 50 entrepreneur showcase webcasts in 2009 from locations throughout California, culminating in a final competition in San Diego this November with 50 regional finalists vying for cash awards, investor traction, and the title of the Most Innovative Startup in California.

“We’ve been showing recorded elevator pitches on our Business Ascent social network, and some other sites have followed suit,” said Jim Mikles, Executive Producer of the webcast series, “but this is the first program that presents entrepreneurs pitching their companies in a real-time, competitive format to potentially hundreds of investors screening the deal flow online.”

Our first live program is this Thursday, April 2, starting at 4PM PDT, from the Monterey Bay Innovation Showcase in Watsonville, in the heart of the Monterey Bay region. A panel of six leading angel and venture investors will discuss “Raising Capital in Challenging Times”, followed by ten-minute presentations by seven sensational startups.

If you want a ringside seat to learn more about the next wave of entrepreneurs emerging from the nation’s most innovative state, join the webcast by visiting http://businessascent.com/go/webcast

Saturday, March 21, 2009

88X ROI

We've been watching some talks from the recent TED conference. For those who may be unfamiliar with this program, it is an annual colloquium of the brightest and most imaginative thinkers, thought leaders, and overachievers from the worlds of Technology, Entertainment, and Design, discussing "Ideas worth spreading".

We've been watching some talks from the recent TED conference. For those who may be unfamiliar with this program, it is an annual colloquium of the brightest and most imaginative thinkers, thought leaders, and overachievers from the worlds of Technology, Entertainment, and Design, discussing "Ideas worth spreading".

Wednesday, March 18, 2009

Required Reading

When I was in college, guys usually pretended they were in a band. Now they pretend they are in a start-up.

- Entrepreneurs are "orphans and outcasts"; solitary, antisocial nerds making widgets in isolation

Entrepreneurs may be more independent than the usual suits who merely follow the rules, but they almost always need business partners and social networks to succeed.

- Entrepreneurs are young.

The Kauffman Foundation examined 652 American-born bosses of technology companies set up in 1995-2005 and found that the average boss was 39 when he or she started. The number of founders over 50 was twice as large as that under 25.

- Entrepreneurship is driven by venture capital

Monitor, a management consultancy that has recently conducted an extensive survey of entrepreneurs, emphasises the importance of “angel” investors, who operate somewhere in the middle ground between venture capitalists and family and friends. They usually have some personal connection with their chosen entrepreneur and are more likely than venture capitalists to invest in a business when it is little more than a budding idea.

- Entrepreneurs must create world-changing new technology

Sir Ronald Cohen, the founder of Apax Partners, one of Europe’s most successful venture-capital companies, points out that some of the most successful entrepreneurs concentrate on processes rather than products. Richard Branson made flying less tedious by providing his customers with entertainment. Fred Smith built a billion-dollar business by improving the delivery of packages. Oprah Winfrey has become America’s richest self-made woman through successful brand management.

- Entrepreneurship cannot occur in large companies

Many big companies work hard to keep their people on their entrepreneurial toes. Johnson & Johnson operates like a holding company that provides financial muscle and marketing skills to internal entrepreneurs. Jack Welch tried to transform General Electric from a Goliath into a collection of entrepreneurial Davids. Jorma Ollila transformed Nokia, a long-established Finnish firm, from a maker of rubber boots and cables into a mobile-phone giant; his successor as boss of the company, Olli-Pekka Kallasvuo, is now talking about turning it into an internet company.Just as importantly, big firms often provide start-ups with their bread and butter. In many industries, especially pharmaceuticals and telecoms, the giants contract out innovation to smaller companies. Procter & Gamble tries to get half of its innovations from outside its own labs. Microsoft works closely with a network of 750,000 small companies around the world. Some 3,500 companies have grown up in Nokia’s shadow.

- Managing entrepreneurship

- Time for entrepreneurship

- The United States of Entrepreneurs

- Entrepreneurs in India and China

- Lands of opportunity

- The formula for entrepreneurship

- Entrepreneurs doing good

- The entrepreneurial society

Thursday, February 26, 2009

Tom Hayes Stimulus Package

- First, kill Sarbanes-Oxley or make it voluntary. Right now.

- Allow entrepreneurs to more easily tap tax-free retirement accounts -- or better yet, let them create tax-free accounts specifically to fund themselves.

- Eliminate payroll taxes, which unnecessarily burden young companies.

- Make the tax system more forgiving for Angel investors -- or allow the creation of tax-free investment vehicles similar to what we now see with nonprofit foundations or 529 college savings funds.

- Lower capital gains taxes on investments in early stage companies and higher taxes on later stage deals.

- Help big business think small.

- Convene a presidential summit on entrepreneurship and small business. The last president to do so was Ronald Reagan in 1982.

Tuesday, February 24, 2009

In the "Q"

Technological innovations, especially high-level ones, usually have limited economic or commercial importance unless complemented by lower-level innovations. Breakthroughs in solid-state physics, for example, have value for the semiconductor industry only if accompanied by new microprocessor designs, which themselves may be largely useless without plant-level tweaks that make it possible to produce these components in large quantities. A new microprocessor’s value may be impossible to realize without new motherboards and computers, as well.

New know-how and products also require interconnected, nontechnological innovations on a number of levels. A new diskless (thin-client) computer, for instance, generates revenue for its producer and value for its users only if it is marketed effectively and deployed properly. Marketing and organizational innovations are usually needed; for example, such a computer may force its manufacturer to develop a new sales pitch and materials and its users to reorganize their IT departments.

Techno-nationalists and techno-fetishists oversimplify innovation by equating it with discoveries announced in scientific journals and with patents for cutting-edge technologies developed in university or commercial research labs. Since they rarely distinguish between the different levels and kinds of know-how, they ignore the contributions of the other players—contributions that don’t generate publications or patents.

They oversimplify globalization as well—for example, by assuming that high-level ideas and know-how rarely if ever cross national borders and that only the final products made with it are traded. Actually, ideas and technologies move from country to country quite easily, but much final output, especially in the service sector, does not. The findings of science are available—for the price of learned books and journals—to any country that can use them. Advanced technology, by contrast, does have commercial value because it can be patented, but patent owners generally don’t charge higher fees to foreigners. In the early 1950s, what was then a tiny Japanese company called Sony was among the first licensors of Bell Labs’ transistor patent, for $50,000.

Since innovation is not a zero-sum game among nations, and high-level science and engineering are no more important than the ability to use them in mid- and ground-level innovations, the United States should reverse policies that favor the one over the other, and it should cease to worry that the forward march of the rest of the human race will reduce it to ruin.

Immigration policies that favor high-level research by preferring highly trained engineers and scientists to people who hold only bachelor’s degrees are misguided too. By working in, say, the IT departments of retailers and banks, immigrants who don’t have advanced degrees probably make as great a contribution to the US economy as those who do. Likewise, the US patent system is excessively attuned to the needs of R&D labs and not enough to those of innovators developing mid- and ground-level products, which often don’t generate patentable intellectual property under current rules and are often threatened by easily obtained high-level patents.

Monday, February 23, 2009

Silver Lining Dept.

I think there are exceptions to the rule when it comes to small tech companies. In this down economy there are real needed innovations that are very critical to significantly reduce IT costs. That empowers smaller companies to negotiate with the big guys because the technologies they develop can really jeopardize critical revenue streams of these firms while providing huge OPEX reductions for customers.

We recently moved a 3,000 user call center app for Wyndham Hotels from Sybase to Oracle where the customer didn’t need to change a single line of application code. The whole migration lasted one week compared to the multi-month/multi-year application migration process that Wyhdham might have embarked without deploying our product.

I truly believe that smaller/innovative companies that can significantly reduce IT costs in this economy are the exception to the rule and we will be in the driver seat when negotiating alliances with big IT vendors.

Wednesday, February 18, 2009

California Business Ascent Announced

MEDIA CONTACTS:

Josh Morgan for Golden Capital

(916) 941-0901

FOR IMMEDIATE RELEASE

Golden Capital Network, California Business, Transportation and Housing Agency, California’s Small Business Advocate, and California Association for Local Economic Development Announce Statewide Initiative to Help Growth Oriented Businesses Climb Out of Economic Doldrums

Private and State Groups Coming Together for

Sacramento and Chico, California - Feb. 18, 2009— Golden Capital Network (www.goldencapital.net), along with the California Business, Transportation and Housing Agency, California’s Small Business Advocate, and the California Association for Local Economic Development today announced the California Business Ascent (www.businessascent.com), a statewide competition and mentoring program to identify, assist and encourage innovation-based, locally-owned companies throughout California.

“Local-businesses focused on growth are the key for

The California Business Ascent will include regional competitions in up to 25 communities throughout

"

The initiative is a unique new type of public/private partnership that includes both State government and local government leaders, and new types of private sector partners including entrepreneurs, angel investors, and venture capitalists. Through this process contestants will make important connections with investors, bankers, professional services providers, executives, policymakers and other entrepreneurs on a statewide basis. In-kind professional expertise and a substantial cash prize (amount TBD) will be provided to the winner of the competition.

“The California Business Ascent provides a new economic development tool for cities, counties and local economic development corporations to add value to their locally-owned growth companies,” said Wayne Schell, president and CEO of the California Association for Local Economic Development, ”These companies represent a critical and growing part of California’s local and regional economies, and until now have been difficult to assist with more traditional types of economic development activities.”

Wavepoint Ventures (www.wavepointventures.com) is participating in the California Business Ascent by helping to engage

Cities and regions throughout the state including the Yolo region, Greater Stockton and

Other cities and regions interested in participating should contact the California Business Ascent initiative organizers at Golden Capital Network, 530-893-8828.

For more information about the California Business Ascent, please visit www.businessscent.com.

ABOUT GOLDEN CAPITAL NETWORK

Golden Capital Network is a non-profit networking, training and consulting group that fosters growth entrepreneurship and early-stage investing as an engine for economic growth.

Since 1999, GCN has coached and showcased more than 1,000 companies to more than 500 active angel and venture capital investors. GCN’s venture capital showcases are the largest and most robust events of their type. The GCN event formula has resulted in more than $1.3 billion raised by presenting companies. More information on Golden Capital is available at www.goldencapital.net.

ABOUT THE BUSINESS, TRANSPORTATION AND HOUSING AGENCY

Led by Secretary Dale E. Bonner, the Business, Transportation and Housing Agency includes 13 departments and several economic development programs and commissions consisting of more than 44,000 employees and a budget of $20 billion, a budget larger than that of almost half the states in the nation. The Agency's portfolio is one of the largest and most diverse in the State of